Your Financial Future,

Simplified

Financial planning designed to protect what you're building - and what comes next.

Building Your Financial Future

Many people spend their days focused on their families, careers, and personal lives. They simply do not have the time and energy to manage and execute their financial decisions effectively.

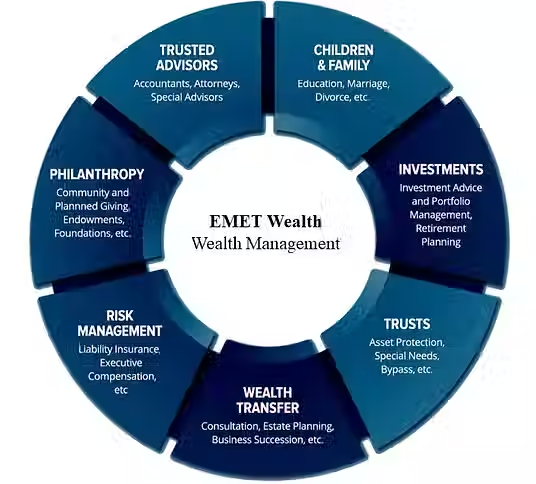

Many of our clients have multiple moving parts. Whether it's an attorney or accountant, we will work with them to understand your goals and how to best reach them. Working together, we'll build a plan to guide you through life's many chapters.

"Everyone has a plan, whether by design or default. As we go through life, we are constantly making financial decisions. These choices shape and build your financial picture."

Defending Against Capital Invaders

Along the way capital invaders will affect your long-term goals. Our structured process has a view of your complete financial picture.

Inflation

Erodes your purchasing power over time, reducing the real value of your savings.

Rising Taxes

Reduces your take-home wealth and impacts long-term financial strategies.

Market Volatility

Creates uncertainty in investments, affecting portfolio growth and retirement plans.

Unexpected Expenses

Disrupts long-term plans and can derail your financial goals.

We take time to understand you, your goals, and your concerns. With proper focus and attention, we can help build a path to a successful financial future.

Our 6-Step Planning Process

A comprehensive approach to achieving your financial goals

STEP 01

Introduction

Getting to know you is our number one priority. During our first meeting, we will spend time to truly understand your goals and concerns. We will discuss our philosophy and process. This is the start of our financial relationship.

STEP 04

Recommendations

Knowledge, knowledge, knowledge! We believe in educating the client on their current status, their many options and what to expect. We want you to have the facts. An informed client can make the best financial decisions.

STEP 02

Discovery

The more we know about you, the greater value we can provide. During the fact gathering we will learn about the financial decisions you have made. This includes the numbers and your goals. Having a holistic view gives us an expanded vision on areas of focus.

STEP 05

Implementation

Now you put your plan to work. Our team will make sure your execution is seamless. We'll work with you each step of the way.

STEP 03

Research & Analysis

This is where we roll up our sleeves and get down to work. Proper research will lead us to the right strategies. Using our many tools and services we will develop a comprehensive financial plan to address your financial goals.

STEP 06

Momentum

Financial planning is a constant work in progress. Your life changes as does the world around you. Reviews ensure our clients are on track to defeat their goals.

Take Control of Your Financial World

Your Personal Financial Management website makes it easy to securely manage your wealth

Through our financial planning software, you will have access to your financial world at any time or place. You have instant access to assets, expenses, net worth and performance.

Get a clear picture of what track your finances are heading in. Construct cash flow models to get a view of your progress and success.

Take your finances with you. With instant access, financial confidence and control is always in the palm of your hand.

Access to secure a vault allows you to upload and save important documents. You'll have these documents at your fingertips at every point.

It Doesn't Stop There

We believe proper review and evaluation will help keep the client on track. With consistent calls, meetings and updates you'll be at the forefront of your financial plan

Regular progress reviews and plan adjustments

Proactive updates as your life circumstances change

Coordination with your other financial professionals

Access to advanced planning software and tools

Consistent communication through calls and meeting